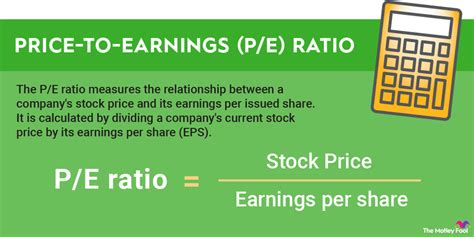

iwc pe ratio calculation | Price Earnings Ratio iwc pe ratio calculation When combined with EPS, the P/E ratio helps gauge if the market price accurately reflects the company’s earnings (or earnings potential). The price-to-earnings ratio can also be . cēzars. 1. vēsturisks Romas impērijas valdnieka oficiālais nosaukums kopš Jūlija Cēzara Oktaviāna. 2. Cēzara balva — Francijas kinobalva. Romas impērijas valdnieka oficiālais nosaukums kopš Jūlija Cēzara Oktaviāna.

0 · iShares Micro

1 · Price to Earnings Ratio Calculator

2 · Price to Earnings (P/E) Ratio Calculator

3 · Price Earnings Ratio

4 · Price

5 · P/E Ratio Mastery: Invest Like a Wall Street Pro (Proven)

6 · P/E Ratio (Price

7 · How Do I Calculate the P/E Ratio of a Company?

LOUIS VUITTON Ceinture Inventeur Tour Reversible Belt Damier Graphite M9632. office wigi stores (486) 97.8% positive; Seller's other items Seller's other items; Contact seller; US $239.90. or Best Offer. . Louis Vuitton Damier Handbags for Women, Louis Vuitton Damier Briefcases for Women,

Get the pe ratio charts for iShares Micro-Cap ETF (IWC). 100% free, no signups. Get 20 years of historical pe ratio charts for IWC. Tons of financial metrics for serious investors. When combined with EPS, the P/E ratio helps gauge if the market price accurately reflects the company’s earnings (or earnings potential). The price-to-earnings ratio can also be . P/E ratio = price / EPS. The price-to-earnings ratio calculator is a tool that helps you calculate the price/earnings ratio (P/E ratio) -an indicator that measures the attractiveness . The Price-to-Earnings-to-Growth ratio, also called the PEG ratio, measures a company's current P/E ratio against its estimated growth potential to more accurately .

It is calculated by dividing the current stock price by the previous 12 months earnings per share (EPS). A PE Ratio of 12 means you would pay for every of earnings .The price-to-earnings (PE) ratio is the ratio between a company's stock price and earnings per share. It measures the price of a stock relative to its profits. You calculate the PE ratio by . The price-to-earnings ratio (P/E) is a commonly used metric in stock fundamental analysis. Learn how to calculate and use the P/E ratio.On this page is a price-to-earnings calculator or P/E ratio calculator. Enter a company's price per share and annual earnings per share, or total market cap and total earnings in one year to .

Price earnings (P/E) ratio = /2.8 = 20. Interpretation. The company's P/E ratio is 5.36. This means that the market price of an ordinary share at John Trading Concern is 20 .The Shiller PE. Robert Shiller first proposed a ten year timeframe for his CAPE ratio, targeting it towards the S&P 500 - the most well known American stock index. Subsequently, CAPE has been adapted for a number of other countries and indexes. The Shiller PE is a valuation measure, much like its cousin the price to earnings ratio.However, the Shiller PE tries to work around the .Formula: PE Ratio = Stock Price / Earnings Per Share. You can find the stock price and EPS by entering the stock's ticker symbol into the search form of various finance and investing websites. Another way to calculate the PE ratio is by dividing the company's market cap with its total net income. Formula: PE Ratio = Market Cap / Net Income . We can calculate the P/E ratio for FDX as of Feb. 9, 2024, when the company's stock price closed at 2.62. . The PEG ratio measures the relationship between the price/earnings ratio and .

iShares Micro

Now, figure out its price-to-earnings for 2020. Let us assume there is another company ABC Ltd. whose PE ratio is 211.17. Now, find out which investment opportunity of the two is more beneficial. Given: Price per share = 7.42; Earnings per share = .39; PE Ratio = Price Per Share/ Earnings Per Share; PE Ratio = 197.42/ 1.39; PE Ratio = 142.03

Assume XYZ company, If their EPS is Rs.10 per share, and the current market price is Rs. 200 per share. Then, its PE ratio will be 20 (200/ 10). It indicates that for every Rs.1 earning, the investor is willing to pay Rs.20. Types of Price-to-Earnings (P/E) Ratio. Primarily there are two types of PE ratio: Forward PE Ratio and Trailing PE Ratio . Price Earnings Ratio Calculator. By Mehtab August 28, 2024. Enter the price per share (in USD): Enter the earnings per share (EPS in USD): Calculate Price to Earnings (P/E) Ratio: The Price to Earnings (P/E) ratio is a crucial metric for evaluating the valuation of a company’s stock. Investors use the P/E ratio to determine whether a stock is .

PEG Ratio = Price/Earnings divided by Annual EPS Growth Consider the following example: Company X has a price per share of and an earnings per share of .50 for this year and .20 for last year.- A better way of interpreting the P/E ratio is by assessing the industry peculiarities and the future growth prospects a company has too. How to calculate the price earnings ratio? Either you do it by hand or by using this PE ratio calculator, as explained above basically there are required two values that should be given:The Fundamentals of PE Ratio. What is PE Ratio? Unveiling the essence of how to calculate PE ratio, this section delves into the basic definition and significance of Price-to-Earnings ratio in the investment landscape. Why is PE Ratio Important? Explore the critical role that PE ratio plays in evaluating a company’s financial health and its . Calculation and Examples of P-E Ratio Example 1: Calculating price-earnings ratio for company’s Stock. Stock price of , Net income = million; Outstanding shares = 1 million; Answer: To calculate its P/E ratio, we first need to calculate its EPS. EPS Calculation: Net Income: million; Outstanding Shares: 1 million

Price to Earnings Ratio Calculator

The PEG Ratio is a security’s price/earnings to growth ratio. That means it shows a stock or index’s price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified .

PE Calc ulator; Business Valuation Calculator Using Price Earning Multiple. Get an overview of your company’s valuation based on the earnings and price to earnings (PE). Business valuation using a PE multiple is a common and simple method of determining business value. Unlocking Investment Insights: Understand the PE/PB Ratio and Optimize Your Portfolio, review the formula for calculating the PE/PB ratio and how to use it in your analysis. . These ratios are easy to calculate, and comparing them with the industry average or benchmarks like the S&P 500 can help inform investment decisions. In this article .

rolex 16234 blu romani jubilee bracelet

Get the pe ratio charts for iShares Micro-Cap ETF (IWC). 100% free, no signups. Get 20 years of historical pe ratio charts for IWC. Tons of financial metrics for serious investors. The P/E ratio shows whether a company’s stock price is overvalued or undervalued and can reveal how a stock’s valuation compares to its industry group.

When combined with EPS, the P/E ratio helps gauge if the market price accurately reflects the company’s earnings (or earnings potential). The price-to-earnings ratio can also be calculated by dividing the company’s equity value (i.e. market capitalization) by its net income. P/E ratio = price / EPS. The price-to-earnings ratio calculator is a tool that helps you calculate the price/earnings ratio (P/E ratio) -an indicator that measures the attractiveness of shares. The Price-to-Earnings-to-Growth ratio, also called the PEG ratio, measures a company's current P/E ratio against its estimated growth potential to more accurately determine if a stock is under or overvalued.

It is calculated by dividing the current stock price by the previous 12 months earnings per share (EPS). A PE Ratio of 12 means you would pay for every of earnings if you invested. It’s only meaningfully used to compare companies in the same industry. How to Calculate The PE Ratio. The PE Ratio has two parts:The price-to-earnings (PE) ratio is the ratio between a company's stock price and earnings per share. It measures the price of a stock relative to its profits. You calculate the PE ratio by dividing the stock price with earnings per share (EPS). Formula: PE Ratio = Price Per Share / . The price-to-earnings ratio (P/E) is a commonly used metric in stock fundamental analysis. Learn how to calculate and use the P/E ratio.

Price to Earnings (P/E) Ratio Calculator

On this page is a price-to-earnings calculator or P/E ratio calculator. Enter a company's price per share and annual earnings per share, or total market cap and total earnings in one year to compute a company's PE ratio.

Price Earnings Ratio

Price

P/E Ratio Mastery: Invest Like a Wall Street Pro (Proven)

Nevada (NV) Las Vegas. Things to do in Las Vegas. Rhumbar. 260 reviews. Bars & ClubsCigar Bars. This location was reported permanently closed. Write a review. About. Mix and mingle at RHUMBAR with a specialty cocktail in one hand, a cigar in the other, and a stunning view of The Strip before you.

iwc pe ratio calculation|Price Earnings Ratio