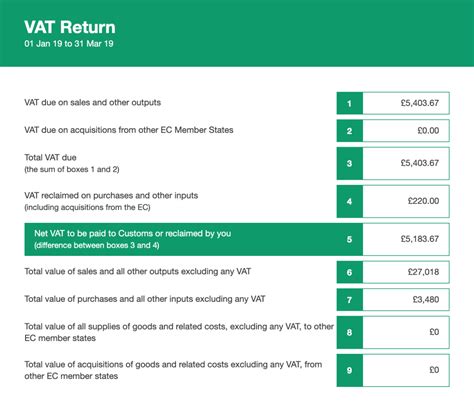

chanel uk tax refund | UK return on vat chanel uk tax refund how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a resident outside the European Union and are able to present your original passport. Immediately recognizable by its black dial featuring large 3, 6 and 9 hour markers and a prominent minutes scale, the Air‑King continues Rolex’s long association with aviation which dates back to the 1930s. More than a tribute, this robust and sporty watch, donned with a 40 mm Oystersteel case, symbolizes the fearlessness of aviation .

0 · terminal 5 Heathrow vat refund

1 · tax refund for shopping UK

2 · UK vat refund

3 · UK return on vat

4 · UK refunds for tourists

$7,900.00

how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a resident outside the European Union and are able to present your original passport.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In disappointing news for UK luxury brands and customers from abroad, the UK has reversed course on its plan to reinstate the VAT refund (see below). Just last month, then Chancellor of the Exchequer Kwasi Kwarteng . Is Chanel Tax-Free at Heathrow Airport? Since January 2021, the tax-free program has ended in the UK. This means that there is no VAT refund for shopping Chanel at .I am planning to purchase a Chanel or Dior handbag in London. I know UK does not allow to claim the tax refund at the airport any more, but you can still ship it to a US address. I have a few .

I am planning to purchase a Chanel or Dior handbag in London. I know UK does not allow to claim the tax refund at the airport any more, but you can still ship it to a US address. I have a few .The VAT Tax Refund is a 12% percent discount you receive when buying goods over 175.01€. When you purchase these goods you fill out a form, then at the train station or airport you drop .

Tax Contribution. In 2021, the CHANEL’s total taxes paid amounted .9 billion, exclusive of taxes collected on the behalf of others (e.g. VAT and certain employee taxes). The make-up of the . To clarify what we mean by VAT free is better than a refund, we made a calculation between buying at Heathrow airport and at the boutiques.We took the current retail price of the .

how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a resident outside the European Union and are able to present your original passport.

You can either get paid immediately at a refund booth, for example at the airport, or send the approved form to the retailer or their refund company. The retailer will tell you how you’ll get. If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In disappointing news for UK luxury brands and customers from abroad, the UK has reversed course on its plan to reinstate the VAT refund (see below). Just last month, then Chancellor of the Exchequer Kwasi Kwarteng announced that non-UK shoppers would once again be able to claim back the VAT tax.

Is Chanel Tax-Free at Heathrow Airport? Since January 2021, the tax-free program has ended in the UK. This means that there is no VAT refund for shopping Chanel at Heathrow Airport. This new rule also applies to other shops like Dior and Hermes. Even Louis Vuitton is no longer tax-free at Heathrow. The tax-free program ended when Brexit came .I am planning to purchase a Chanel or Dior handbag in London. I know UK does not allow to claim the tax refund at the airport any more, but you can still ship it to a US address. I have a few questions: 1. Does Chanel or Dior still have this VAT refund service? What documents should I bring to do the paperwork? 2. What will the process for VAT .I am planning to purchase a Chanel or Dior handbag in London. I know UK does not allow to claim the tax refund at the airport any more, but you can still ship it to a US address. I have a few questions: 1. Does Chanel or Dior still have this VAT refund service? What documents should I bring to do the paperwork? 2. What will the process for VAT .The VAT Tax Refund is a 12% percent discount you receive when buying goods over 175.01€. When you purchase these goods you fill out a form, then at the train station or airport you drop off the form in the mailbox and receive your refund. This refund is a game changer when it comes to purchasing designer bags.

Tax Contribution. In 2021, the CHANEL’s total taxes paid amounted .9 billion, exclusive of taxes collected on the behalf of others (e.g. VAT and certain employee taxes). The make-up of the taxes paid is set out below, with corporation income taxes representing over half of the total amount of taxes paid. TOTAL. To clarify what we mean by VAT free is better than a refund, we made a calculation between buying at Heathrow airport and at the boutiques.We took the current retail price of the Chanel Jumbo Classic Flap Bag, which is £4450 GBP (price as per June 2017).how can i receive a tax refund when making a purchase (excluding department stores)? For all purchases greater than £25, you can receive a tax refund on the day of purchase if you are a resident outside the European Union and are able to present your original passport.You can either get paid immediately at a refund booth, for example at the airport, or send the approved form to the retailer or their refund company. The retailer will tell you how you’ll get.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. In disappointing news for UK luxury brands and customers from abroad, the UK has reversed course on its plan to reinstate the VAT refund (see below). Just last month, then Chancellor of the Exchequer Kwasi Kwarteng announced that non-UK shoppers would once again be able to claim back the VAT tax.

Is Chanel Tax-Free at Heathrow Airport? Since January 2021, the tax-free program has ended in the UK. This means that there is no VAT refund for shopping Chanel at Heathrow Airport. This new rule also applies to other shops like Dior and Hermes. Even Louis Vuitton is no longer tax-free at Heathrow. The tax-free program ended when Brexit came .I am planning to purchase a Chanel or Dior handbag in London. I know UK does not allow to claim the tax refund at the airport any more, but you can still ship it to a US address. I have a few questions: 1. Does Chanel or Dior still have this VAT refund service? What documents should I bring to do the paperwork? 2. What will the process for VAT .I am planning to purchase a Chanel or Dior handbag in London. I know UK does not allow to claim the tax refund at the airport any more, but you can still ship it to a US address. I have a few questions: 1. Does Chanel or Dior still have this VAT refund service? What documents should I bring to do the paperwork? 2. What will the process for VAT .The VAT Tax Refund is a 12% percent discount you receive when buying goods over 175.01€. When you purchase these goods you fill out a form, then at the train station or airport you drop off the form in the mailbox and receive your refund. This refund is a game changer when it comes to purchasing designer bags.

Tax Contribution. In 2021, the CHANEL’s total taxes paid amounted .9 billion, exclusive of taxes collected on the behalf of others (e.g. VAT and certain employee taxes). The make-up of the taxes paid is set out below, with corporation income taxes representing over half of the total amount of taxes paid. TOTAL.

terminal 5 Heathrow vat refund

chanel duo lip 174

Consequently, ‘Red Submariner’ watches from the 1970s are among the most collectible vintage Rolex models on the planet. Also of interest to collectors, Rolex made a bunch of small adjustments to their ‘Red Submariner’ dials throughout the decade, resulting in a range of collectible dial variations.

chanel uk tax refund|UK return on vat